fresh start initiative irs reviews

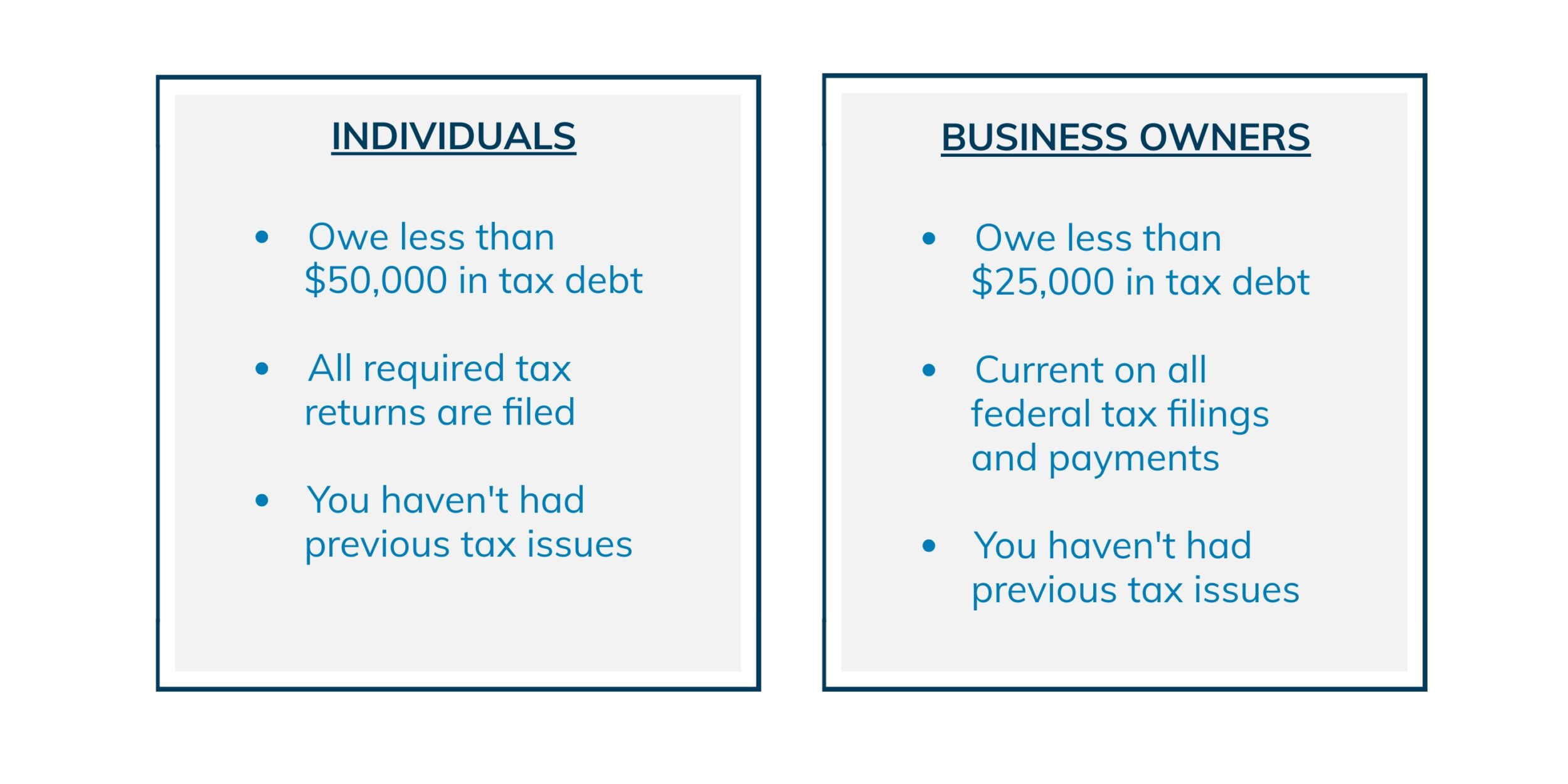

ASCII characters only characters found on a standard US keyboard. Taxpayers who owe less than 50000 may apply online with the IRS and dont have to complete an IRS Collection Information Statement Form 433-A.

3 Myths Surrounding The Irs Fresh Start Program

2016 the IRS released an online tool for taxpayers.

. IRS Fresh Start Initiative. While they may employ attorneys CPAs and enrolled agents pursuant to IRS Regulation Circular 230 the use of the term Tax Attorney is used as a general or generic term referencing attorneys seasoned in aspects of tax relief and collection work. We help you explore debt relief avenues such as offers in compromise abatement of penalties IRS installment agreements IRS fresh start initiative and innocent spouse tax relief.

Must contain at least 4 different symbols. Under its FRESH START INITIATIVE the IRS raised the threshold for streamlined installment agreements from 25000 to 50000 in tax debt and the maximum repayment term from five to six years. The tax resolution companies referenced herein are not law firms nor are such representations being made.

6 to 30 characters long. A Notice 703 is a brief worksheet the Internal Revenue Service uses to help. This tool acts as.

We can help you figure it out using one of four easy methods. Rated 45 5 out of 424 reviews. IRS Fresh Start Initiative.

Two additional Withdrawal options resulted from the Commissioners 2011 Fresh Start initiative. One option may allow withdrawal of your Notice of Federal Tax Lien after the liens release. Removed terminology from paragraph 1 about the Fresh Start initiative and added Note to clarify that the criteria for withdrawal differs from other IA criteria.

Removed references to credit reports in examples in paragraph 2 to reflect recent changes in credit reporting industry. IRS Payment Plan Audits. The IRS files a public document the Notice of Federal Tax Lien to alert creditors that the government has a legal right to your property.

Dont wait for those scary IRS notices to find out. Use the IRSs handy online system. Our tax relief attorneys work with taxpayers to help them get out of sticky situations.

Rated 45 5 out of 424 reviews. 5 IRM 5129321.

Irs S Fresh Start Program Expands Payment Options

Irs Fresh Start Initiative A Guide To The Fresh Start Tax Program

3 Ways To Be Eligible For The Irs Fresh Start Program

3 Ways To Be Eligible For The Irs Fresh Start Program

Irs Fresh Start Program Tax Debt Relief Initiative Free Consultation

Fresh Start Initiative Review A Tax Relief Service Lendedu

:max_bytes(150000):strip_icc()/anthem_tax_services_gradient_transparent-03-01-10f2e88fe6914a4fb1e8221ba8b1ac62.png)

The 7 Best Tax Relief Companies Of 2022

Do I Qualify For The Irs Fresh Start Program

Irs Fresh Start Program Makes It Easier To Settle Back Taxes Debt Com

Irs Fresh Start Connecting Taxpayers With Tax Professionals

Desperate For Revenue Connecticut Revenue Services Blasts Out Fresh Start Audit Letters

Best Tax Relief Companies Top 6 Tax Debt Resolution Services Of 2022

3 Ways To Be Eligible For The Irs Fresh Start Program

Fresh Start Initiative Review A Tax Relief Service Lendedu

Clear Start Tax Relief Home Facebook

Taxrise 5 Star Reviews Ratings From Satisfied Clients

Irs Fresh Start Program How It Can Help W Your Tax Problems

How The Irs Fresh Start Program Can Get You Back On Your Feet